Roku’s fourth-quarter earnings report was met with disappointment from investors and analysts, who had expected the streaming platform to meet or exceed Wall Street’s estimates.

Revenue of $865.3 million missed the consensus estimate of $894M, representing a 33% YOY growth rate and a drop in stock price of over 7%. The company reported 60.1m active accounts, up 17% from a year ago, and 19.5 billion streaming hours, up 15%.

Key Takeaways from Roku’s Q4 Earnings Report

The key takeaways from Roku’s Q4 report are that revenue growth has slowed since the prior quarter, resulting in weak guidance and missing analyst expectations; however, active accounts and streaming hours continue to experience strong growth YOY.

In addition, ad sales revenue grew 61% YoY to $259 million driven by higher video advertising dollars.

Business Performance & Outlook Deteriorates as Competition Heats Up

Platform revenue of $297 million missed estimates due to weaker-than-expected device sales. Although the number of active accounts increased by 17%, the average revenue per user decreased by 4%.

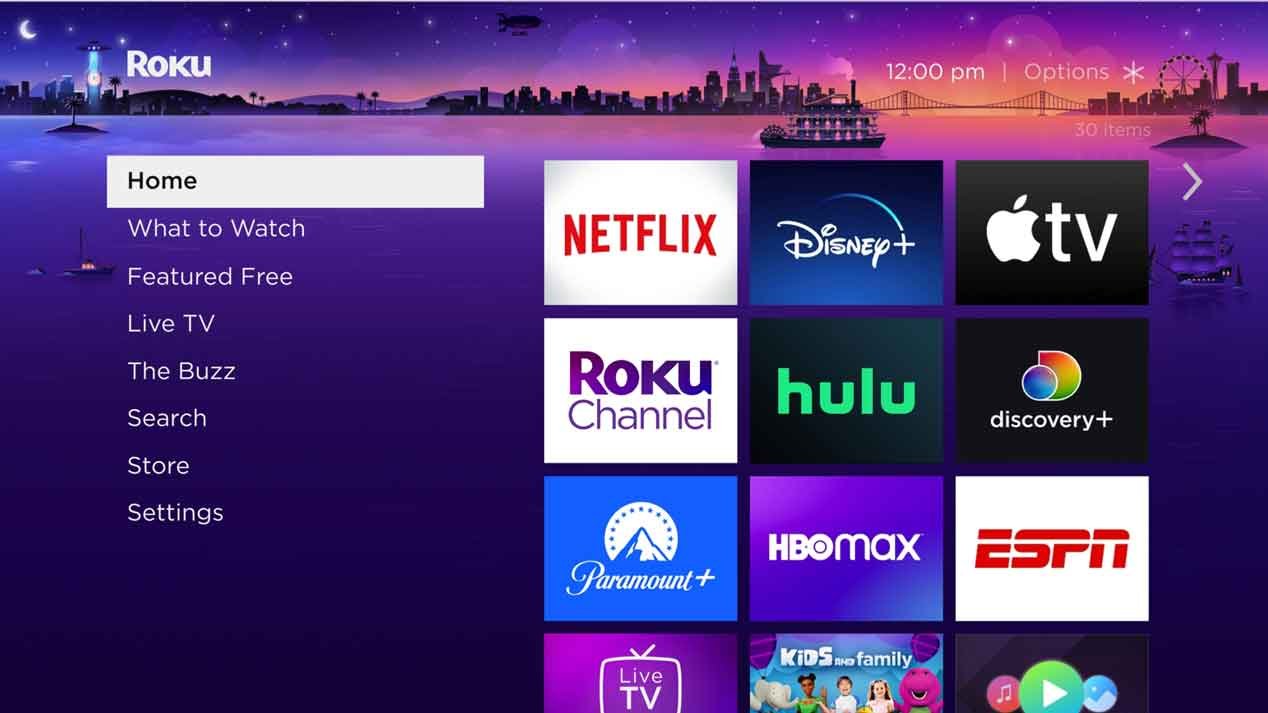

As competition heats up among streaming services such as Amazon Prime Video, Disney+, and Apple TV+, these results suggest that Roku must find ways to differentiate itself in order to capture market share and improve its financial performance going forward.

CEO Anthony Wood provided some insight into his strategy for tackling this challenge: “We plan to continue building on our leadership position by focusing on four key areas: providing scale through device distribution, driving engagement with users through content discovery innovations, creating more ways for advertisers to reach their audiences using our ad platform solutions, and delivering value for developers through our OS platform investments.”

Looking Ahead: What Investors Should Keep in Mind?

At this point it is very difficult to make any definitive judgments about Roku’s future prospects given the competitive landscape within the streaming industry, however, there are a few factors investors should keep an eye on as they consider investing in the company moving forward:

1. Engagement & User Acquisition

Roku will need to continue increasing its user base while also finding ways to increase engagement among existing users if it hopes to maintain or increase its average revenue per user (ARPU). This could be achieved through some combination of new product launches (such as Roku TV models) or exclusive content deals with major studios/networks.

2. Ad Sales

With ad sales already accounting for 28% of total revenues in Q4 2019 it is clear that this is an area where Roku can continue growing its business without having to rely heavily on device sales or subscription fees from third-party services like Netflix etc.

Thus Roku will need to focus on expanding its ad offerings as well as enhancing targeting capabilities for brands/advertisers looking for more effective ROI out of their campaigns.

3. Competitive Advantage

Finally, it is important that Roku maintains or expands upon what makes them unique compared to other streaming platforms such as Amazon Prime Video & Hulu, etc., particularly when it comes to innovation around content discovery & recommendation algorithms used by viewers when browsing titles available across different providers.

Conclusion

Roku’s Q4 earnings report provides a clear indication that the streaming industry is becoming increasingly competitive and Roku must find ways to differentiate itself if it hopes to capture market share.

The company has identified four key areas for growth, including device distribution, content discovery innovations, ad platform solutions, and OS platform investments.

Investors should keep an eye on engagement & user acquisition, ad sales revenue growth as well as any potential advantages they can gain over competitors in order to make informed decisions moving forward.

With these considerations in mind, Roku seems poised for continued success despite the fierce competition present within the streaming industry today.